INSIGHTS

Wind in the Willows

Logistics and Chinese Black Box – Fear Guides Massive Economic Shifts

Chinese Black Box. The WSJ highlighted stories about China shutting down the data sources to communicate their economic activity to the outside world

Speaking of Things That Will Make the Fed’s Life Difficult – The Dollar

The Dollar. Some assume that the dollar moves with the strength of the economy, some assume it has to do with rates, others still see a strong or weak currency

Building Boom – We’re in the Strangest Places if You Look at it Right

Building boom. Even in the wake of a third major bank failure in 2023, the US Economy seems relatively unfazed by a continued string of bad news.

Willow Creek Partners Celebrates its 6th Anniversary!

Willow Creek Partners celebrated its 6th anniversary! We're grateful to our investors, employees, and partners for their unwavering support and dedication

1 Meme Stock Down – Understanding the Difference Between a Funding Gap and Secular Change

Meme stock down. At the end of 2013, BBBY common stock was worth more than $17B.

Worker Migration Makes Inflation Contagious

Worker migration. Workers move for a lot of different reasons. Some are looking for a better paying job, others are looking for more affordable housing

Believe it if You Need it, or Leave it if You Dare – Rural Places Need More Workers

Rural Places Need More Workers. Every couple of years the government finds ways to commit more to investing in infrastructure

Office Sublet - An Indication of Valuation Uncertainty

Westside Los Angeles Office is a relatively narrow market. It is also an area of the country that is seeing a particularly acute problem for office rents.

Millennials, Homes, and Multifamily

It’s been a weird few years for young people. Millennials have seen the dotcom crash, the global financial crisis and Covid- 19, all at critical life stages.

Trouble Ahead, Trouble Behind: Consumer Debt and BNPL Better Watch Their Speed

Trouble Ahead, Trouble Behind: Consumer Debt and BNPL Better Watch Their Speed. It is of critical importance to understand the mental state of the consumer.

The IRS Got One Right!!!

It’s not very often that investors appreciate the IRS, so this is a moment that we should celebrate!!!!

PE Buying PE Debt

Over the past few weeks, we’ve spoken a bit about the financial creativity of private equity firms.

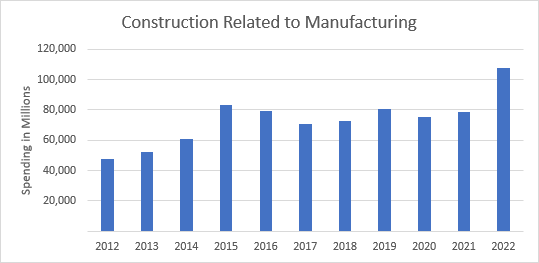

Construction and Factory Work is Back in the US!!!

Construction and factory work. One of the more difficult tasks economists have to face is gauging how much politicians are overpromising before underdelivering.

Since it Costs a Lot to Win, and Even More to Lose, You and me Better Spend Some Time, Wondrin’ What to Choose.

Last Wednesday the Labor Department released their Consumer Price Index (CPI) data and while these data were in line with expectations (maybe a little better), there is a continued expectation for rates to increase another 25bp at the next Federal Reserve meeting. Year over year numbers suggest core inflation around 5.6% which is still a far cry from the Fed’s 2% target, but month over month data suggesting 0.1% is actually quite exciting as it is down from 0.4% a month ago.

Getting Leverage as a Private Equity Buyer

Getting Leverage as a Private Equity Buyer. Investors and asset owners continue to explore deals, but given the uncertainty, the bid-ask spreads are WIDE.

More Rough Sledding For Stock Pickers

The last 20 years have been rough for Stock Pickers. Public assets have been under fire from peers, Indexed ETFs, Quants and Private Assets.

Valuations in PE… Are They Too High?

2022 performance differentials caused and continues to cause investors to rethink some of what they know about different asset classes. For instance, history would suggest that stocks and bonds are not usually highly correlated…but they were in 2022.

Rent Control Hurts New Investment

Rent control. There is another story about shortages in affordable housing. Part of that is a story about inflation, but part of it is a story about bad policy

Death of the Sunbelt Grossly Exaggerated

With a nod to Mark Twain, the death of the Sunbelt economy and job market have been grossly exaggerated. Over the last decade, many cities in the Sun Belt have seen tremendous growth in jobs and population. Millennials have been moving south in droves chasing better job prospects and warmer weather.

The Stock Market Looks Set Up, Like A Bowlin’ Pin and Oil Looks Like Roy Munson

As is often the case, the Stock Market activity does not match up well with headline information or what is expected for earnings going forward.