INSIGHTS

Wind in the Willows

Access is the Most Important Thing - Private Equity Investment in Sports

When you think about sports ownership, you may think about big names like: Robert Kraft, The Steinbrenner Family, Jerry Jones, Jeffrey Vinik, and the like.

ARM Holdings IPO – And the Inevitable Headlines

This week ARM Holdings is poised to launch what will surely be the largest IPO of the year. ARM's been either preparing its IPO or preparing for sale for years

Deficits, Interest Rates, and Inflation – I’m Uncle Sam

One of the often-ignored negatives about increasing interest rates is the effect they have on government spending.

Negative Rent Growth

Tremendous rent growth, backed by a national housing shortage, has greatly encouraged a large build.

CRE Bottom?

One of the most entertaining parts about being a market participant is that there is always someone trying to call a top or bottom.

VCs are Betting on Mining Deals… Why?

There are obviously a lot of reasons why mining might be attractive.

Buffett’s Homebuilder Bet

When the greatest investor in history makes a sizable bet… it’s probably a good idea to pay attention, right?

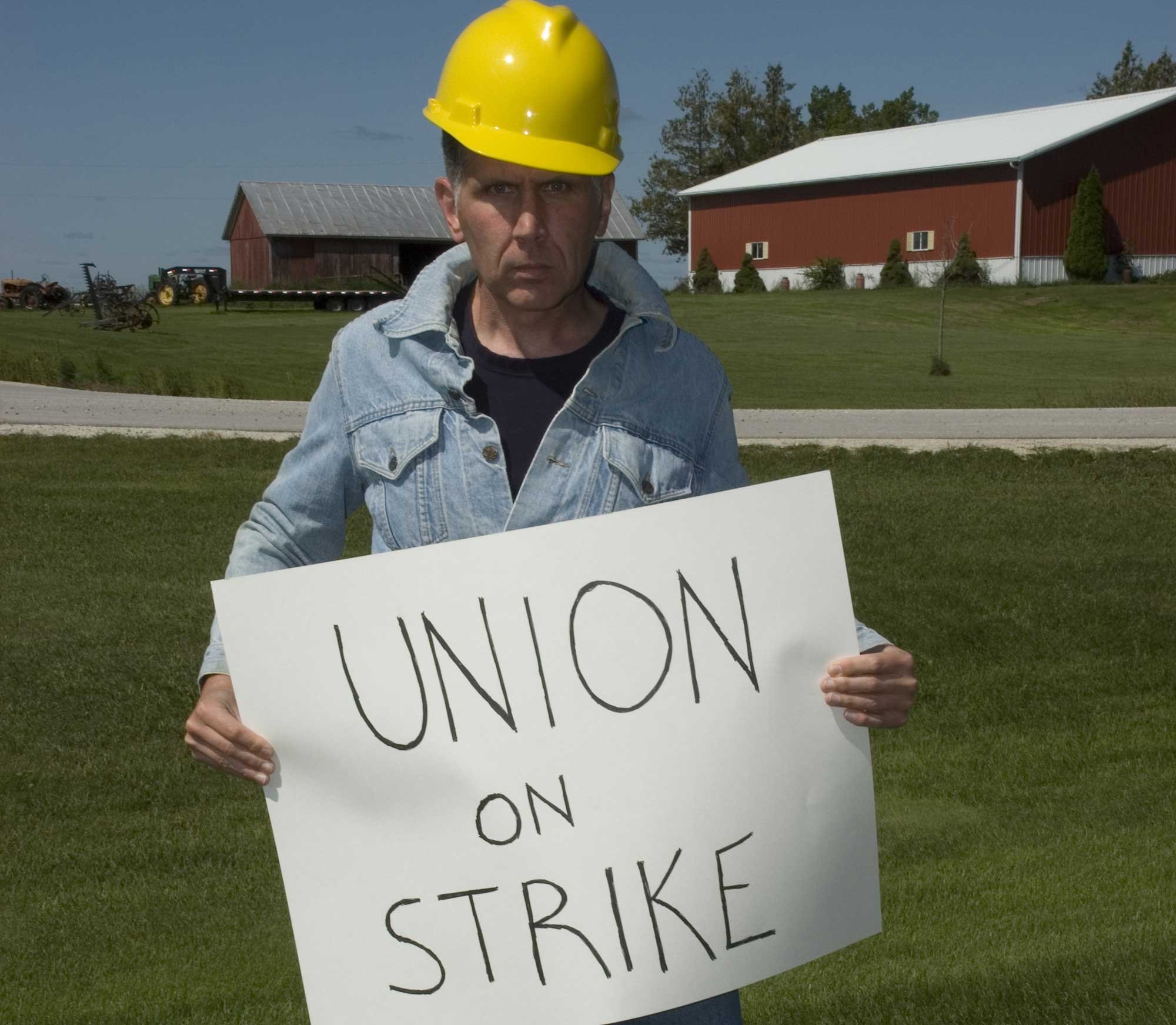

Labor Unions and Inflation: Playing to the Tide

If you’re wondering why it is that inflation continues to be so persistent, you’re not alone.

PE Valuations and Corporate Venture Arms

Private Equity and its close cousin Venture Capital have seen enormous growth over the last few decades, including the emergence of large corporate venture arms

Mortgage Rates And a Little Sympathy

The current average rate on a 30-year mortgage is 7.48%. That number is the highest it’s been since November of 2000.

Government Shutdown? Here we go Again

The US Government’s fiscal year-end is September 30th and Congress still hasn’t learned anything from ratings agency downgrades or market volatility surrounding their negotiations.

New York is Gonna Force It

New York is a unique place, there is no doubt that multifamily and office are more integrated in that city than nearly any other.

Founders Looking For Liquidity In Secondaries?

Just 2 years ago, a founder could clip a coupon of liquidity for themselves worth millions of dollars when they sold shares to an investor.

Problems with Insurance

We’ve touched on insurance a few times in Wind in the Willows, but the world of insurance has changed a lot in the last year.

BofA Fund Manager Survey – Is It Time To Go Knife Catching?

Every month, Bank of America releases a survey called the BofA Global Fund Manager Survey, and it’s must-see entertainment for market watchers.

Tax Collectors… How Much Do You Really Like Working From Home?

What happens if the office buildings which typically carry the highest tax burden, aren’t occupied?

Moody’s Downgrades Regional Banks

Moody’s is one of the big three ratings agencies, and considering recent news of Fitch downgrading the US Government to AA+, it seems they were due to make some headlines

Lessons Learned from the Death of a Trucker

Not every acquisition goes well. Many times, acquisitions take place for what seems like all the right reasons, and the execution never lives up to the hype.

No More Cheap Stuff – Light A Candle And Curse The Glare

It may not be intuitive to the lay person why a private investment company with a history of real estate investments would care about international trade.

Zoom – The Beginning of the End? Or the Beginning of the End?

The most user-friendly at the beginning of the pandemic was from Zoom Communications, and almost overnight, Zoom became a verb.