INSIGHTS

Wind in the Willows

Too Big to Fail Means “Safe”?

In today’s episode of Regulatory Roulette, we’re reminded of the phrase “Too Big To Fail” and what it meant in the darkest days of the Global Financial Crisis. This phrase was used to discuss the biggest and nastiest of our systemic issues as Lehman Brothers failed and AIG, Citigroup and others teetered before TARP ultimately came to the rescue. Today, it’s means something different.

Understanding the CHIPS Act and What it Can do For the US Economy

In the summer of 2022, the Biden Administration, together with Congress, passed The CHIPS and Science Act.

The Finger Pointing Game

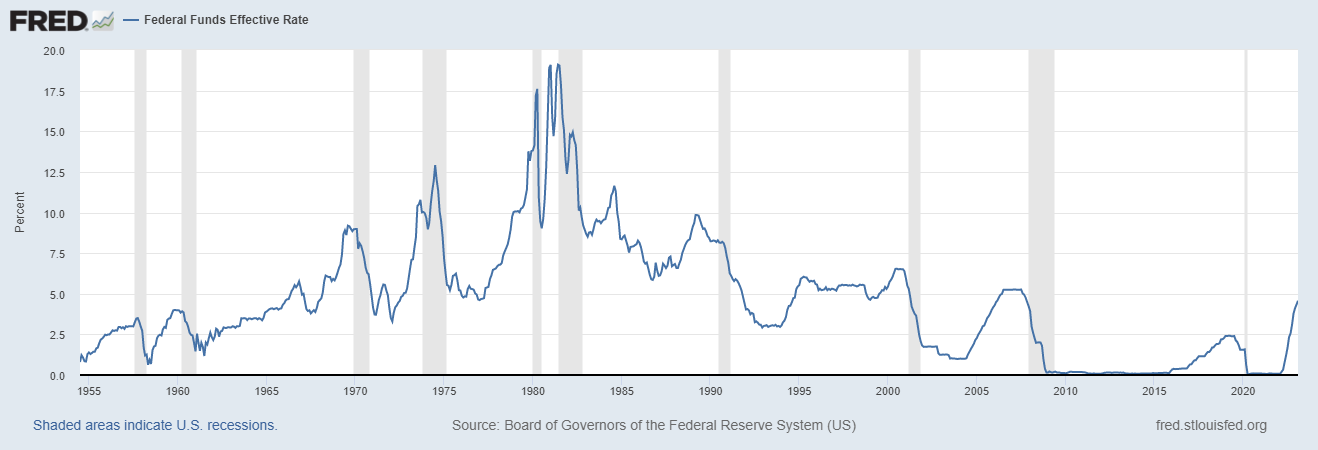

We’ll gladly get on board and criticize the Fed for any number of things. Money printing in the months following the initial shock of Covid, not raising rates after the Global Financial Crisis, chickening out late in 2018 during the “Taper Tantrum”…the list goes on. But to suggest that the ills of the banking system and commercial real estate markets are “all their fault”? Well that’s a step too far for us.

Rent Growth – There is a Road, But it’s No Simple Highway

2022 ended with a giant thud for rent growth. As can be seen in the charts below, vacancy rates were up and rent growth was negative by more than it has been in a long time. As 2023 began, the picture appeared slightly rosier for the asset class. Vacancy rates continue to head higher, but a resilient renter has meant 2 months of positive rent growth. This is far from intuitive given recent layoff headlines.

VC to Slow Following SVB Collapse

Years ago, a colleague/mentor shared a truth about the investment industry that few people stop to think about. You can be a good investor, or you can be really good at the investment business…very few people are both. In an ideal world, investment managers combine people with both skills for ultimate success, but few ever find the right mix. But what’s the difference: A good investor, buys low, sells high and manages the risks between. Someone who is good at the investment business is generally really good at gathering assets.

Multi Build? Not all MSAs are The Same

Multi Build? If you’ve been watching WCP operate over the last years, you know that we love irrational markets when they favor taking risks

SVB Blames WFH and There Might be Some Truth to That…

The fallout from SVB’s collapse continues to dominate the news, and we could spend the next 3 days writing about the various pieces and parts of their demise.

Inflation, Banking Crisis, and Shifts in Funding Landscape

It’s not often that we’re going to agree with what Jim Cramer says on CNBC, so soak this in. The issues we have seen with SVB, Credit Suisse, Signature and even Silvergate are anti-inflationary. These problems, though each has their own nuance, are likely to increase bank scrutiny on every new loan that is issued. This should result in decreasing asset values on real estate, venture capital, private equity, real assets, etc.

Shifting Landscape of Consumer Spending and What it Means for Real Estate

Stephen Squeri, chairman and chief executive at Amex, said in a letter to shareholders. “Millennial and Gen Z customers, who are our fastest-growing customer cohort in terms of both new account acquisitions and card spending, comprised over 60% of our new consumer proprietary accounts globally”.

CRE and Banking Comeuppance

In talking about bank failures and SVB/Signature, it’s easy to dismiss the problems as unique because these were unique banks. One was focused on VC and the other had huge Crypto exposures. Obviously, these were bad actors, and this couldn’t happen to others right? Well….YES, it can happen to others and sometimes “stable” assets experience major changes in value.

You Know All The Rules By Now

Last week we mentioned that there would be more to the story of SVB and Signature Bank. Frankly, this story has so dominated the news that it is very difficult to avoid even as we think about a very broad set of asset classes. A few days into this crisis we can’t help but feel a touch unsettled by what we’ve seen. The government clearly bailed out depositors.

Every Now and Then, it IS Different This Time

During every economic cycle there is someone who wants to claim that some particular element of the cycle is “different this time”.

More Grey Than Silver Lining

The stories of Silicon Valley Bank and Signature Bank saw the beginning of their end last week as both mismanagement of risk and unfortunate market conditions created the 2nd and 3rd largest bank failures in US history.

Interest Rates and the Godot Recession

Economists love referencing the play “Waiting for Godot”. It is a play in which two people engage in discussions while they wait for their friend Godot.

Who is TINA? Doesn’t Matter, She’s Been Replaced

TINA, or There Is No Alternative, has been a common refrain from public market investors the last several years.

Private Real Estate Funding - I Know the Rent is in Arrears

Private real estate funds had a terrible fund raising year. The drop from 2021 to 2022 was the largest since the Global Financial Crisis and so we’re paying close attention.

Down with ESG!!!

As a reader of Wind in the Willows you will likely see the topic of ESG (Environmental, Social and Governance) investing come up a lot.

Private Equity Investors are Snapping up Data Centers and Here’s Why That’s a Good Idea…

The chart below was created by IDC, but this chart has seen many iterations from many different sources. Every time we look at it, we take a minute to pause and think about what this chart actually says.

New Supply in Multifamily – Fate (and maybe the Fed) Will Decide the Rest

investors paid high prices for Multifamily properties assuming significant rent growth and committed to build significant new supply.