INSIGHTS

Wind in the Willows

Default Doesn’t Require Bad Credit

One of the strangest things we’ve been hearing over the last several months is the idea that if/when a recession comes, it won’t be anything like the Global Financial Crisis because that was a credit problem, whereas, what we see today is a liquidity problem. It’s a fascinating distinction, but we wonder if this nuance may be hiding bigger issues that would have been intuitive in years passed.

Keep On Rollin’ My Old Buddy, You’re Movin’ Much Too Slow - PacWest Selling Real Estate Loans

Keep on rollin'. Banks are looking for ways to save themselves. The process of selling loans to adjust the balance sheet is not a new one.

Apple’s Tie Up With Broadcom

Pay close attention. While we heard the term “Trade War” a lot during the Trump Administration and associated it with tariffs, quotas and subsidies, the more dramatic part is just starting to lift off the ground. Last week, Apple announced a multi-billion-dollar deal with Broadcom to manufacture 5G radio frequency chips in the United States.

Interest Rates And Small Business

It’s easy to underappreciate the effect that increased interest rates really have on the economy. Intuitively, when rates go up, debt gets more expensive.

Consumer Health – Caught In A Slow-Motion Dash For The Door

Consumer health. Last week was this quarter’s consumer week in earnings reporting. Home Depot, Walmart, Target, Foot Locker and TJX all reported.

Hotels, Office, Chicago, Oh My

Some cities are a fast fail in today’s lending environment. We’ve spoken at some length about some of the cities in California and how the new taxes and a difficult regulatory environment have made it nearly impossible to do business in once (and recently) great cities.

Conferences Boosting Economies

It may not always seem it, but the world is returning to some sense of normalcy. Take the conference scene for example. When Covid-19 first hit, the world was tracking super spreader events that triggered the outbreak.

Fed – Everyone’s an Expert and No One Knows for Sure

Fed…everyone has something to say about the Fed. Whether it’s coming from the inside of the Fed, billionaire investors, or the guru of all things interest rates

The Old Playbook… Or the New?

The pursuit of profit in down markets has always been difficult. Academics have searched for years to find assets that go up in down markets or down in up markets. Market technicians have been scanning charts and data for decades in pursuit of durable patterns and inflection points with the hope of finding better hedges. They use measures of volume and direction to determine what happens next.

Banking Crisis Continues – Ya Ain’t Got Half of What You Thought You Had

Banking Crisis Continues. Anytime an industry is cumulatively down 35%, investors and the media start asking when the right time is to step in and buy.

California’s Self-Inflicted Wounds

Last month Los Angeles’ so called Mansion Tax went into effect. This tax, supported by 57% of voters was intended to help the city’s problem with homelessness. Instead, this tax is likely to crush sales of properties worth over $5M, and devastate transactions in properties over $10M. While this transfer of wealth is called the Mansion Tax, the name is a complete misstatement of what the tax actually is.

Private Equity – Next Stage of the Cycle

We’ve spoken about the creativity of private equity firms and the current imbalance in the need for capital vs the capital that is currently being deployed

VC, Tech, and A Good Vintage

No, we’re not talking about wine. Warren Buffet once famously said, “Be greedy when others are fearful and fearful when others are greedy” and as investors these words are particularly valuable around market inflections. Following the fall of yet another bank with ties to the venture capital and private equity community (First Republic), we are sharply reminded of what fear really looks like.

Logistics and Chinese Black Box – Fear Guides Massive Economic Shifts

Chinese Black Box. The WSJ highlighted stories about China shutting down the data sources to communicate their economic activity to the outside world

Speaking of Things That Will Make the Fed’s Life Difficult – The Dollar

The Dollar. Some assume that the dollar moves with the strength of the economy, some assume it has to do with rates, others still see a strong or weak currency

Building Boom – We’re in the Strangest Places if You Look at it Right

Building boom. Even in the wake of a third major bank failure in 2023, the US Economy seems relatively unfazed by a continued string of bad news.

Willow Creek Partners Celebrates its 6th Anniversary!

Willow Creek Partners celebrated its 6th anniversary! We're grateful to our investors, employees, and partners for their unwavering support and dedication

1 Meme Stock Down – Understanding the Difference Between a Funding Gap and Secular Change

Meme stock down. At the end of 2013, BBBY common stock was worth more than $17B.

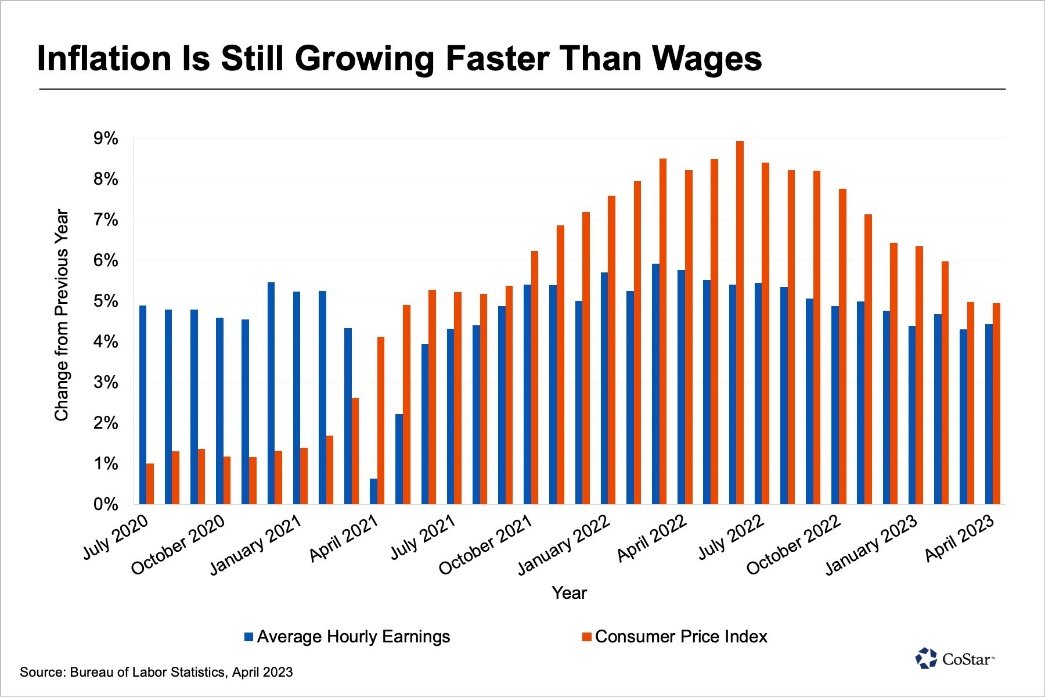

Worker Migration Makes Inflation Contagious

Worker migration. Workers move for a lot of different reasons. Some are looking for a better paying job, others are looking for more affordable housing

Believe it if You Need it, or Leave it if You Dare – Rural Places Need More Workers

Rural Places Need More Workers. Every couple of years the government finds ways to commit more to investing in infrastructure