INSIGHTS

Wind in the Willows

Office Sublet - An Indication of Valuation Uncertainty

Westside Los Angeles Office is a relatively narrow market. It is also an area of the country that is seeing a particularly acute problem for office rents.

Millennials, Homes, and Multifamily

It’s been a weird few years for young people. Millennials have seen the dotcom crash, the global financial crisis and Covid- 19, all at critical life stages.

Trouble Ahead, Trouble Behind: Consumer Debt and BNPL Better Watch Their Speed

Trouble Ahead, Trouble Behind: Consumer Debt and BNPL Better Watch Their Speed. It is of critical importance to understand the mental state of the consumer.

The IRS Got One Right!!!

It’s not very often that investors appreciate the IRS, so this is a moment that we should celebrate!!!!

PE Buying PE Debt

Over the past few weeks, we’ve spoken a bit about the financial creativity of private equity firms.

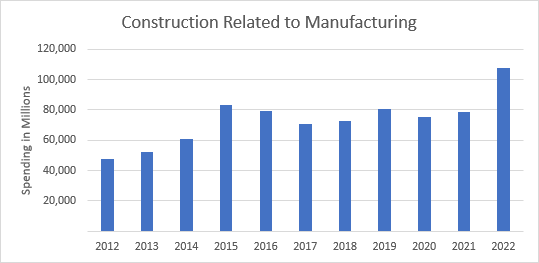

Construction and Factory Work is Back in the US!!!

Construction and factory work. One of the more difficult tasks economists have to face is gauging how much politicians are overpromising before underdelivering.

Since it Costs a Lot to Win, and Even More to Lose, You and me Better Spend Some Time, Wondrin’ What to Choose.

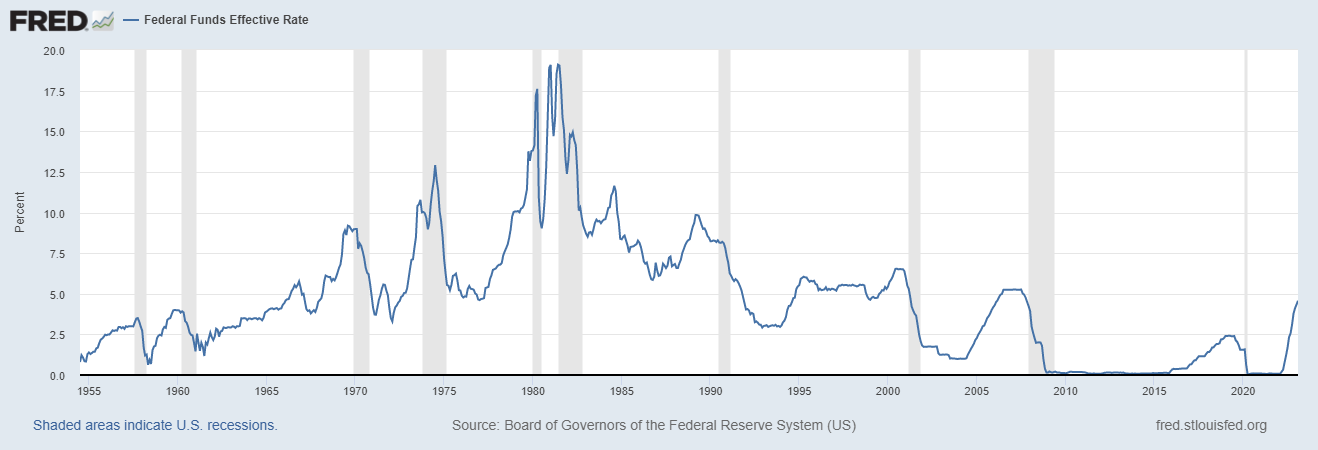

Last Wednesday the Labor Department released their Consumer Price Index (CPI) data and while these data were in line with expectations (maybe a little better), there is a continued expectation for rates to increase another 25bp at the next Federal Reserve meeting. Year over year numbers suggest core inflation around 5.6% which is still a far cry from the Fed’s 2% target, but month over month data suggesting 0.1% is actually quite exciting as it is down from 0.4% a month ago.

Getting Leverage as a Private Equity Buyer

Getting Leverage as a Private Equity Buyer. Investors and asset owners continue to explore deals, but given the uncertainty, the bid-ask spreads are WIDE.

More Rough Sledding For Stock Pickers

The last 20 years have been rough for Stock Pickers. Public assets have been under fire from peers, Indexed ETFs, Quants and Private Assets.

Valuations in PE… Are They Too High?

2022 performance differentials caused and continues to cause investors to rethink some of what they know about different asset classes. For instance, history would suggest that stocks and bonds are not usually highly correlated…but they were in 2022.

Rent Control Hurts New Investment

Rent control. There is another story about shortages in affordable housing. Part of that is a story about inflation, but part of it is a story about bad policy

Death of the Sunbelt Grossly Exaggerated

With a nod to Mark Twain, the death of the Sunbelt economy and job market have been grossly exaggerated. Over the last decade, many cities in the Sun Belt have seen tremendous growth in jobs and population. Millennials have been moving south in droves chasing better job prospects and warmer weather.

The Stock Market Looks Set Up, Like A Bowlin’ Pin and Oil Looks Like Roy Munson

As is often the case, the Stock Market activity does not match up well with headline information or what is expected for earnings going forward.

Too Big to Fail Means “Safe”?

In today’s episode of Regulatory Roulette, we’re reminded of the phrase “Too Big To Fail” and what it meant in the darkest days of the Global Financial Crisis. This phrase was used to discuss the biggest and nastiest of our systemic issues as Lehman Brothers failed and AIG, Citigroup and others teetered before TARP ultimately came to the rescue. Today, it’s means something different.

Understanding the CHIPS Act and What it Can do For the US Economy

In the summer of 2022, the Biden Administration, together with Congress, passed The CHIPS and Science Act.

The Finger Pointing Game

We’ll gladly get on board and criticize the Fed for any number of things. Money printing in the months following the initial shock of Covid, not raising rates after the Global Financial Crisis, chickening out late in 2018 during the “Taper Tantrum”…the list goes on. But to suggest that the ills of the banking system and commercial real estate markets are “all their fault”? Well that’s a step too far for us.

Rent Growth – There is a Road, But it’s No Simple Highway

2022 ended with a giant thud for rent growth. As can be seen in the charts below, vacancy rates were up and rent growth was negative by more than it has been in a long time. As 2023 began, the picture appeared slightly rosier for the asset class. Vacancy rates continue to head higher, but a resilient renter has meant 2 months of positive rent growth. This is far from intuitive given recent layoff headlines.

VC to Slow Following SVB Collapse

Years ago, a colleague/mentor shared a truth about the investment industry that few people stop to think about. You can be a good investor, or you can be really good at the investment business…very few people are both. In an ideal world, investment managers combine people with both skills for ultimate success, but few ever find the right mix. But what’s the difference: A good investor, buys low, sells high and manages the risks between. Someone who is good at the investment business is generally really good at gathering assets.

Multi Build? Not all MSAs are The Same

Multi Build? If you’ve been watching WCP operate over the last years, you know that we love irrational markets when they favor taking risks