INSIGHTS

Wind in the Willows

SVB Blames WFH and There Might be Some Truth to That…

The fallout from SVB’s collapse continues to dominate the news, and we could spend the next 3 days writing about the various pieces and parts of their demise.

Inflation, Banking Crisis, and Shifts in Funding Landscape

It’s not often that we’re going to agree with what Jim Cramer says on CNBC, so soak this in. The issues we have seen with SVB, Credit Suisse, Signature and even Silvergate are anti-inflationary. These problems, though each has their own nuance, are likely to increase bank scrutiny on every new loan that is issued. This should result in decreasing asset values on real estate, venture capital, private equity, real assets, etc.

Shifting Landscape of Consumer Spending and What it Means for Real Estate

Stephen Squeri, chairman and chief executive at Amex, said in a letter to shareholders. “Millennial and Gen Z customers, who are our fastest-growing customer cohort in terms of both new account acquisitions and card spending, comprised over 60% of our new consumer proprietary accounts globally”.

CRE and Banking Comeuppance

In talking about bank failures and SVB/Signature, it’s easy to dismiss the problems as unique because these were unique banks. One was focused on VC and the other had huge Crypto exposures. Obviously, these were bad actors, and this couldn’t happen to others right? Well….YES, it can happen to others and sometimes “stable” assets experience major changes in value.

You Know All The Rules By Now

Last week we mentioned that there would be more to the story of SVB and Signature Bank. Frankly, this story has so dominated the news that it is very difficult to avoid even as we think about a very broad set of asset classes. A few days into this crisis we can’t help but feel a touch unsettled by what we’ve seen. The government clearly bailed out depositors.

Every Now and Then, it IS Different This Time

During every economic cycle there is someone who wants to claim that some particular element of the cycle is “different this time”.

More Grey Than Silver Lining

The stories of Silicon Valley Bank and Signature Bank saw the beginning of their end last week as both mismanagement of risk and unfortunate market conditions created the 2nd and 3rd largest bank failures in US history.

Interest Rates and the Godot Recession

Economists love referencing the play “Waiting for Godot”. It is a play in which two people engage in discussions while they wait for their friend Godot.

Who is TINA? Doesn’t Matter, She’s Been Replaced

TINA, or There Is No Alternative, has been a common refrain from public market investors the last several years.

Private Real Estate Funding - I Know the Rent is in Arrears

Private real estate funds had a terrible fund raising year. The drop from 2021 to 2022 was the largest since the Global Financial Crisis and so we’re paying close attention.

Down with ESG!!!

As a reader of Wind in the Willows you will likely see the topic of ESG (Environmental, Social and Governance) investing come up a lot.

Private Equity Investors are Snapping up Data Centers and Here’s Why That’s a Good Idea…

The chart below was created by IDC, but this chart has seen many iterations from many different sources. Every time we look at it, we take a minute to pause and think about what this chart actually says.

New Supply in Multifamily – Fate (and maybe the Fed) Will Decide the Rest

investors paid high prices for Multifamily properties assuming significant rent growth and committed to build significant new supply.

Multifamily Dynamics

Abruptly changing interest rates have a really interesting effect on human behavior. What we’ve seen over the last year is that rather than acting to position themselves for raising rates, market participants on both sides have decided to sit on their hands.

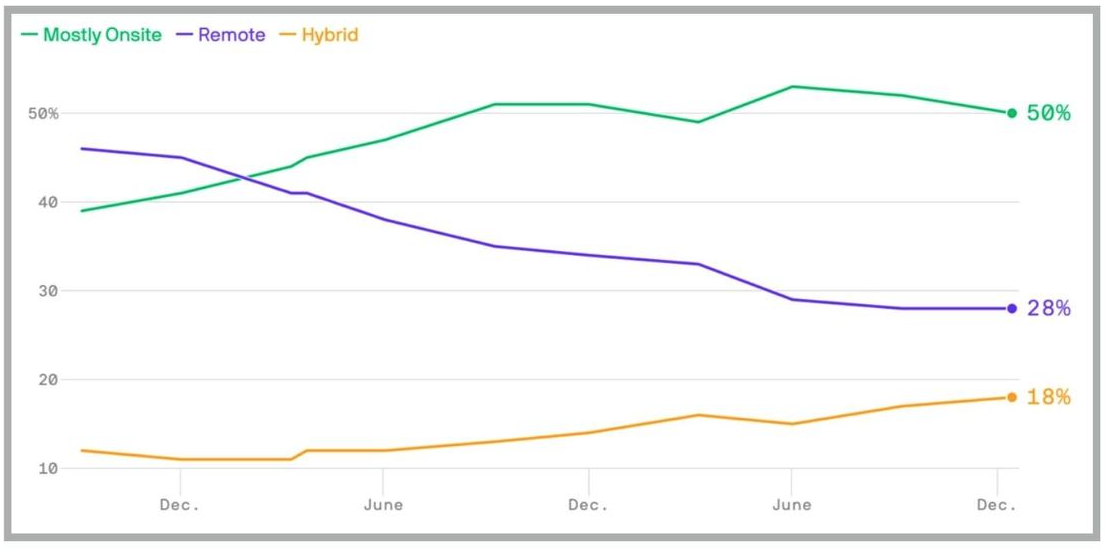

Will Workers Return to the Office Faster Than we Think?

Will Workers Return to the Office Faster Than we Think?

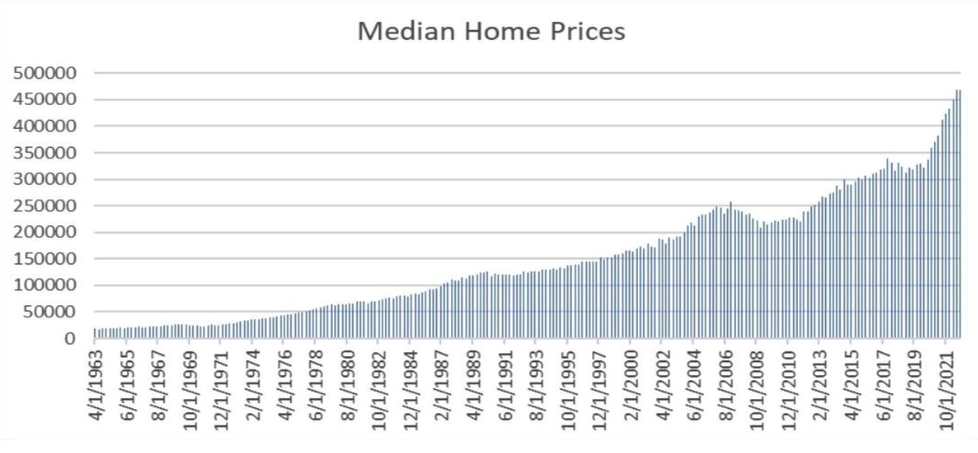

Rise of the Millionaire Renter

Most people, when they think back to the Great Financial Crisis, they think of excess. Excesses in leverage, lackadaisical analysis of credit and a glut of housing. And yes, that was what led to the financial crisis, but in the wake of the FC, a fascinating thing occurred. Banks worked hard to fix their loan books, home builders slowed their activity and investors nearly forgot single family housing. For good reason too.