INSIGHTS

Wind in the Willows

CRE Bottom?

One of the most entertaining parts about being a market participant is that there is always someone trying to call a top or bottom.

Affordable Housing Reset

Affordable Housing Reset. As if the problem wasn’t acute enough, the US is about to hit a wave of new uncertainty for affordable housing.

Deltek Architectural Billings Index – A Fascinating Uptick

Deltek Architectural Billings Index – A Fascinating Uptick. Capital markets experts have been very focused on commercial real estate and a loan wall that is approaching in Q4 of 2023.

Fed Funds, International Central Banking, and Multifamily Real Estate

Fed Funds, international central banking. On Wednesday of last week, the Federal Reserve made its highly anticipated pause in interest rate hikes following CPI Data that suggested that inflation continues to cool. The 4% print was in line with expectations and continues a downward trend that has been in place since June of 2022. Thankfully, it was low enough to warrant pausing to reassess the effectiveness of rate increases from the last year and a half. As we have mentioned in the past, we do not anticipate a rapid decline in rates because while 4% is still getting better, it is still double the Fed’s target of 2%.

CMBS Delinquencies

While Commercial Real Estate has been in the news a lot lately, the struggles that many had predicted hadn’t translated into a really meaningful change in delinquency….until this May.

Worker Migration Makes Inflation Contagious

Worker migration. Workers move for a lot of different reasons. Some are looking for a better paying job, others are looking for more affordable housing

Millennials, Homes, and Multifamily

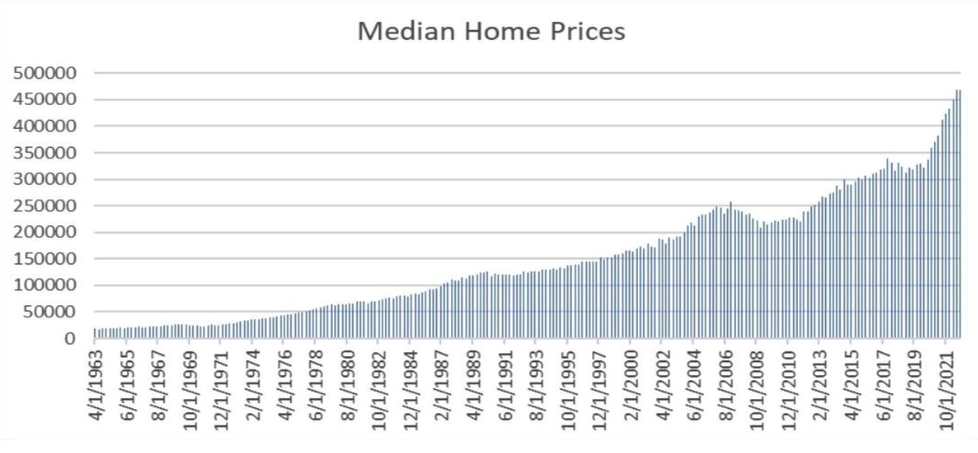

It’s been a weird few years for young people. Millennials have seen the dotcom crash, the global financial crisis and Covid- 19, all at critical life stages.

The Finger Pointing Game

We’ll gladly get on board and criticize the Fed for any number of things. Money printing in the months following the initial shock of Covid, not raising rates after the Global Financial Crisis, chickening out late in 2018 during the “Taper Tantrum”…the list goes on. But to suggest that the ills of the banking system and commercial real estate markets are “all their fault”? Well that’s a step too far for us.

Rent Growth – There is a Road, But it’s No Simple Highway

2022 ended with a giant thud for rent growth. As can be seen in the charts below, vacancy rates were up and rent growth was negative by more than it has been in a long time. As 2023 began, the picture appeared slightly rosier for the asset class. Vacancy rates continue to head higher, but a resilient renter has meant 2 months of positive rent growth. This is far from intuitive given recent layoff headlines.

Multi Build? Not all MSAs are The Same

Multi Build? If you’ve been watching WCP operate over the last years, you know that we love irrational markets when they favor taking risks

Rise of the Millionaire Renter

Most people, when they think back to the Great Financial Crisis, they think of excess. Excesses in leverage, lackadaisical analysis of credit and a glut of housing. And yes, that was what led to the financial crisis, but in the wake of the FC, a fascinating thing occurred. Banks worked hard to fix their loan books, home builders slowed their activity and investors nearly forgot single family housing. For good reason too.