INSIGHTS

Wind in the Willows

Deficits, Interest Rates, and Inflation – I’m Uncle Sam

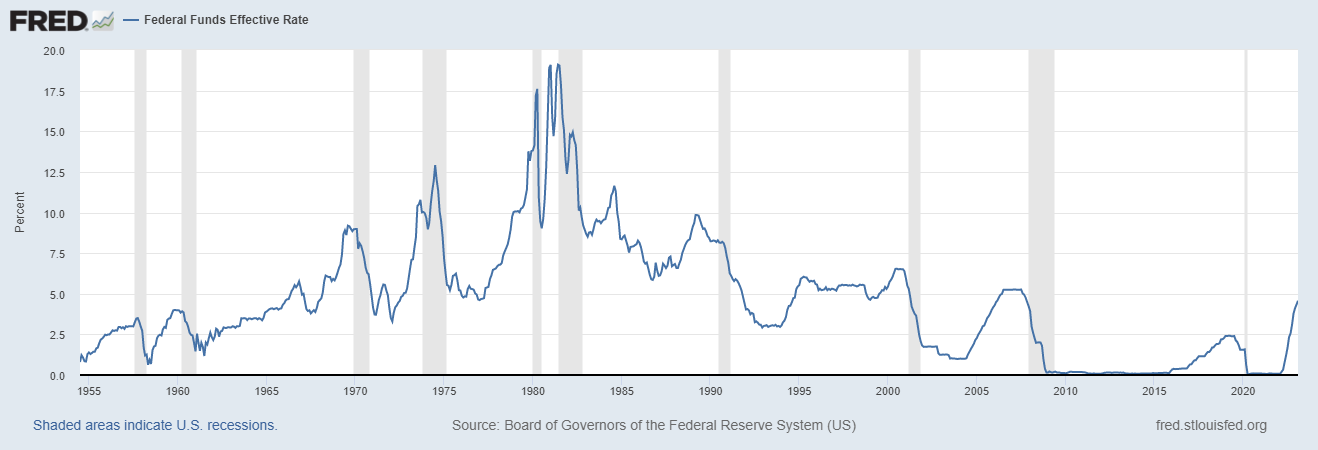

One of the often-ignored negatives about increasing interest rates is the effect they have on government spending.

Unions And Inflation: The More That You Give, The More It Will Take

Unions And Inflation. The Biden Administration thinks a lot about workers.

First Half Consumer Wrap-up

At the midpoint of the year, we like to take stock of the six months that have been and use that context to reassess the back half.

Rent Control Hurts New Investment

Rent control. There is another story about shortages in affordable housing. Part of that is a story about inflation, but part of it is a story about bad policy

The Finger Pointing Game

We’ll gladly get on board and criticize the Fed for any number of things. Money printing in the months following the initial shock of Covid, not raising rates after the Global Financial Crisis, chickening out late in 2018 during the “Taper Tantrum”…the list goes on. But to suggest that the ills of the banking system and commercial real estate markets are “all their fault”? Well that’s a step too far for us.

Inflation, Banking Crisis, and Shifts in Funding Landscape

It’s not often that we’re going to agree with what Jim Cramer says on CNBC, so soak this in. The issues we have seen with SVB, Credit Suisse, Signature and even Silvergate are anti-inflationary. These problems, though each has their own nuance, are likely to increase bank scrutiny on every new loan that is issued. This should result in decreasing asset values on real estate, venture capital, private equity, real assets, etc.