INSIGHTS

Wind in the Willows

Too Big to Fail Means “Safe”?

In today’s episode of Regulatory Roulette, we’re reminded of the phrase “Too Big To Fail” and what it meant in the darkest days of the Global Financial Crisis. This phrase was used to discuss the biggest and nastiest of our systemic issues as Lehman Brothers failed and AIG, Citigroup and others teetered before TARP ultimately came to the rescue. Today, it’s means something different.

VC to Slow Following SVB Collapse

Years ago, a colleague/mentor shared a truth about the investment industry that few people stop to think about. You can be a good investor, or you can be really good at the investment business…very few people are both. In an ideal world, investment managers combine people with both skills for ultimate success, but few ever find the right mix. But what’s the difference: A good investor, buys low, sells high and manages the risks between. Someone who is good at the investment business is generally really good at gathering assets.

SVB Blames WFH and There Might be Some Truth to That…

The fallout from SVB’s collapse continues to dominate the news, and we could spend the next 3 days writing about the various pieces and parts of their demise.

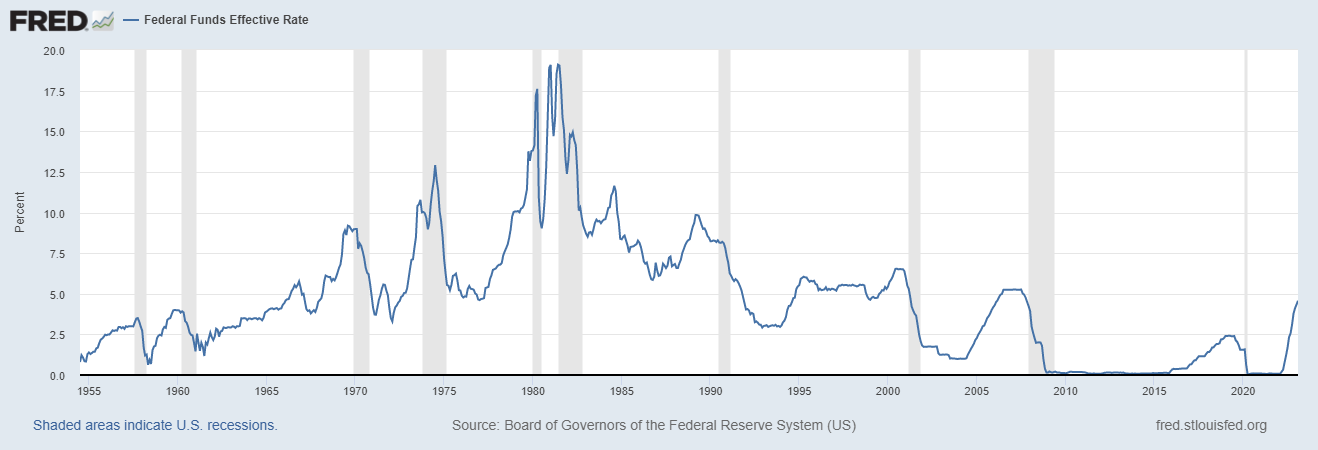

Inflation, Banking Crisis, and Shifts in Funding Landscape

It’s not often that we’re going to agree with what Jim Cramer says on CNBC, so soak this in. The issues we have seen with SVB, Credit Suisse, Signature and even Silvergate are anti-inflationary. These problems, though each has their own nuance, are likely to increase bank scrutiny on every new loan that is issued. This should result in decreasing asset values on real estate, venture capital, private equity, real assets, etc.